Article

Opportunity Evaluation - Pennies, Nickels & Dollars

May 27, 2020

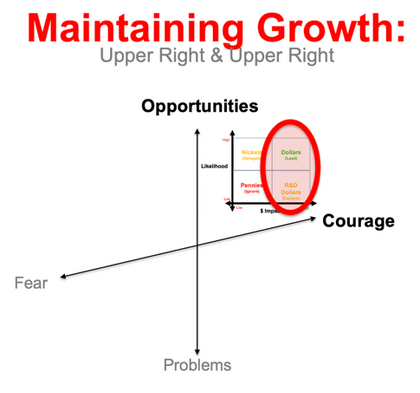

Recently, we shared the 4 Forces of Growth model from my upcoming book The Gravity of Growth to help you to get perspective on where you spend your time and energy, in a business that aspires to keep growing. The model helps you to master how to prioritize and focus on what matters most.

To keep a company growing, you need to put some energy into growth thinking and growth activities, and those are normally found at the intersection of opportunities and courage. Seeing:

- New opportunities for existing customers or

- New customers in existing markets or

- New markets for existing products or services or

- New products and services…

…and then having the courage to test the market, see how it responds and continue to iterate based on what you learn.

We now want to help you decide which of the opportunities you should actually spend the time chasing – either in the growth or improvement quadrants of the business – which we like to look at through the lens of Pennies, Nickels and Dollars.

The Perspective

The challenge for many leaders is that when we get very busy, we become very passionate about problems or opportunities that we see and lack or lose perspective to discern the magnitude of the impact of these issues. We can be pulled into thinking that all problems need to be solved and all opportunities are worthy of being pursued.

Unfortunately, we often find ourselves stepping over a dollar to pick up a nickel, not realizing what we are doing. Ideally, we want to step over the nickels to focus on the dollars.

Energy and resource allocation — capital or human — is one of the most important jobs of a leader. It’s very challenging, sometimes impossible, to get right — unless you have the tools to make better choices.

One of the hardest parts of our job is to have the right perspective and tools so that we can step over the pennies and the nickels and to make sure we’re picking up the dollars. That’s not to say that somebody shouldn’t pick up the nickels, but we need to make sure people don’t miss the dollars because of their obsession with nickels and that those don’t take a dollar’s worth of effort.

One CEO I spoke with recently said that some of his people were looking at trying to manage their line item of rent. After the CEO did the math, he said that if they allocated the executive time to come up with a strategy to support more work at home and other initiatives, they might have a savings of half of 1% of revenue – and that might be a notable savings. His stance was that they would be better off using same amount of organizational energy in initiatives to grow revenues by 10% or 15%. In this case, they’d be far better off not working hard to save the money on rent, if it takes executive energy away from the more impactful effort of increasing sales.

Now it does depend on the context of your business, but the key is to get the discipline to breakdown the ideas to know if they are worth a penny, a nickel or a dollar before people get too excited and invest precious resources in them.

All Opportunities Are Not Equal: Likelihood & Impact

Opportunity evaluation using the the Pennies, Nickels and Dollars Model helps you to evaluate an idea by looking at the likelihood of success, and the size of the dollar impact:

- Pennies box ideas should generally be ignored because there’s a low impact and low likelihood to capitalize. These are the ideas we ideally stop or ignore and nobody in your business should invest more than 30 seconds of time here. Now, if something in this quadrant happens with no effort or on its own, excellent.

- Nickels quadrant ideas have a high likelihood but a low dollar impact — something a CEO or executive shouldn’t spend any time on. Saving money is great discipline and these should be dealt with by the right people in the organization based on the magnitude of the impact.

- Dollars quadrant ideas have a high impact and high likelihood of success. They’re good investments that obviously need some work and due diligence to prove their worth. Just make sure that you’re just not kidding yourself if, in reality, they are riskier than anticipated.

For example, a CEO who spoke to us about international expansion said they’ve been thinking about it for a few months, and talking to lots of people who have expanded into the same country. He needed a few more months to consider if the business was actually capable of make it work, and if he was personally up for the challenge because he’d likely have to move.

A disciplined approach is needed to confirm a high likelihood of success – and worthy of dropping into strategic plans for key leaders in the business to drive. But only if there’s enough return to justify the executive team’s effort. This is where you want to focus.

- R&D dollars quadrant ideas are very high impact but low likelihood, and often people step over these because they don’t know how to make them happen. These can be some of the biggest wins for companies, but they require a lot more work and testing – like in the mining world when they drill test holes to see the concentration of what’s under the surface, to determine if an operation can be profitable.

In many ways, this is what needs to happen here. It can be very, very high value for leaders to spend time doing additional R&D — to dedicate a percentage of their budget to explore and find ways to decrease the risk of these high risk/high reward programs.

Jim Collins describes this as the need to shoot a number of little bullets — a number of micro-tests they can afford to not work, in terms of organizational energy or capital – in order to learn more and find how to make these potentially come to fruition. These are often big wins on which people don’t spend enough time because we’re so focused on short-term results and don’t have enough time for strategic thinking exploration.

Key points:

- Use the Pennies, Nickels, Dollars Model to evaluate the ideas that excite you most

- Make sure that the appropriate ideas, get the appropriate investment of time and resources from the right people

- Make sure the most senior people spend the right amount of time on Dollars and R&D Dollars,

and a mechanism (weekly or monthly meetings) to continue to evolved their thinking and progress on these ideas

To pull this together, with the 4 Forces of Growth model:

If you’re really serious about growth, you want to concentrate your capital and human capital allocation to some degree (depending on your business) on the Growth quadrant, where the best work happens. You want to be further onto the right-hand side of the quadrant for the R&D dollars to have the biggest impact – and to balance it with Improvements, as needed.

You have to have enough energy and win frequently in order to keep that growth going. And, you cannot let pennies congest the system because we can so easily get stuck chasing pennies or nickels, and then wonder why growth isn’t happening.

Final thought

We often start a new project based on a hypothesis of how things will work and what the benefit will be. That’s why a rear-view, after-action review process is critical to evaluate your early thinking of what you thought these opportunities and benefits were. Look back and see what you actually manifested, quarter on quarter or even a few years down the road, versus what you initially thought, to improve your thinking and your ability to make better choices going forward.

The Challenge

- In which Dollar-sized opportunities (or problems) do you need to invest more organizational energy?

- In what Penny- or Nickel-sized opportunities (or problems) do you need to have people stop or minimize their energy?

About Lawrence & Co.

Lawrence & Co. is a growth strategy and leadership advisory firm that helps mid-market companies achieve lasting, reliable growth. Our Growth Management System turns 30 years of experience into practical steps that drive clarity, alignment, and performance—so leaders can grow faster, with less friction, and greater confidence.

About Kevin Lawrence

Kevin Lawrence has spent three decades helping companies scale from tens of millions to hundreds of millions in revenue. He works side-by-side with CEOs and leadership teams across North America, the Middle East, Asia, Australia, and Europe, bringing real-world insights from hands-on experience. Kevin is the author of Your Oxygen Mask First, a book of 17 habits to help high-performing leaders grow sustainably while protecting their mental health and resilience. He also contributed to Scaling Up (Rockefeller Habits 2.0). Based in Vancouver, he leads Lawrence & Co, a boutique firm of growth advisors.