Article

Keeping Your Eye on the Growth Prize: How Not to Get Distracted in the Chaos of Growth

November 3, 2025

When I first started working with entrepreneurs of growing companies nearly thirty years ago, I spent a lot of time testing and experimenting — trying to crack the code of growth. We’d sit in meeting after meeting with brilliant ideas that seemed certain to drive results. Some worked, some didn’t. And for years, I believed the difference came down to execution: maybe the team didn’t work hard enough, or we misunderstood the customer, or we didn’t design the plan well enough.

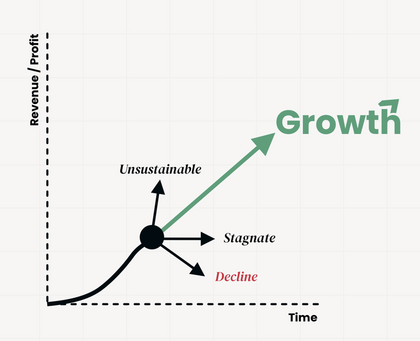

Over time, though, something began to reveal itself. After thousands of experiments, tens of millions of dollars of growth initiatives, and hundreds of leadership teams, patterns started to emerge. What once seemed complex and unpredictable became remarkably simple. The more experience I gained, the clearer it became: most leaders lose their grip on growth not because of lack of effort or intelligence, but because they lose sight of what growth actually is and what drives it.

The Real Definition of Growth

In my new book, The Four Forces of Growth, I introduce a concept called Real Growth—a simple but powerful way to measure whether your company is truly scaling.

Real Growth happens when two things are both true:

- The number of Xs you sell (your core unit — clients, hours, transactions, widgets, or barrels) is increasing.

- Your profit or gross profit per X is at least sustaining, but ideally growing.

In other words:

Real Growth = Growing Your Number of Xs & Sustaining or Ideally Increasing Your Profit per X

Operational Growth vs. Accounting Growth

Often companies fall into the trap of focusing too much on just their income statement — revenues, gross profits, overheads, and EBITDA or net income. These are important, but they can be misleading. You can increase revenue by raising prices or selling a higher-priced product, yet actually sell fewer units. You can grow EBITDA while your customer base shrinks. It looks good on paper — until you realize your market share and momentum are quietly eroding.

That’s why I encourage CEOs to track operational growth—the actual number of Xs — alongside accounting growth. It’s the clearest signal of whether you’re truly scaling your impact or just managing your P&L.

Case in Point: Luis’s Manufacturing Company

In The Four Forces of Growth, I share the story of Luis, a CEO who asked me to diagnose why his company’s sales had stalled. From the outside, everything looked strong: a capable team, enviable margins, and delighted customers. But as we dug in, we discovered every major initiative on the plan was about improvement of a process or cost line item, not growth. Product tweaks. Faster response times. System upgrades. None of it was designed to sell more Xs.

When we finally measured it, unit volume had declined while revenue and profit held up. Once Luis and his team shifted focus to Real Growth — new customers, markets and partnerships, —their growth numbers took off again.

That experience reinforced a lesson I’ve seen play out countless times: Improving your company is not the same as growing it. Better isn’t always bigger.

Balancing Profit and Scale

There are periods when you need to focus on the bottom half of the income statement — cost of goods sold, gross margin, overheads, and ultimately profitability per X. Sometimes that part of the business drifts out of balance, and for a quarter or two (or occasionally longer), you must direct almost all of your company’s energy there to get the business healthy again.

But once profitability is stabilized, you need to shift your focus back to the top of the income statement as well — the other side of Real Growth: increasing your number of Xs.

Ideally, you stay focused on X growth even while improving profitability per X, but every now and then, a short-term reset is required. The key is remembering it’s a phase, not the strategy. Because running efficiently alone will never scale business long-term.

Staying Focused in the Chaos

Growth is inherently messy. The demands, distractions, and crises of running a business can easily pull leaders away from what matters most. But if you embed one simple discipline into your monthly rhythm — tracking the growth of your X and your profit per X — you’ll stay oriented toward the true growth prize.

Yes, still look at revenue, costs and profitability — intensely. But for leadership conversations, strategic debates, and long-term vision, always come back to these two questions:

• Are we selling more Xs?

• Are we making more (or at least not less) on each X?

Because when you keep your eyes on those two numbers, the noise fades. The path forward becomes clearer.

And that’s when real growth — not just improvement, not just activity — starts to compound.

Coach Kevin’s Challenge — Know Your X’s:

- What do you want your X & Profit per X to be in 5 – 10 years?

- What was it 5 – 10 years ago?

You can order The 4 Forces of Growth now on Amazon.ca or Amazon.com — or visit 4ForcesOfGrowth.com for free resources and tools to help you assess and fire up your own growth engine.

Additional Resources:

About Lawrence & Co.

Lawrence & Co. is a growth strategy and leadership advisory firm that helps mid-market companies achieve lasting, reliable growth. Our Growth Management System turns 30 years of experience into practical steps that drive clarity, alignment, and performance—so leaders can grow faster, with less friction, and greater confidence.

About Kevin Lawrence

Kevin Lawrence has spent three decades helping companies scale from tens of millions to hundreds of millions in revenue. He works side-by-side with CEOs and leadership teams across North America, the Middle East, Asia, Australia, and Europe, bringing real-world insights from hands-on experience. Kevin is the author of Your Oxygen Mask First, a book of 17 habits to help high-performing leaders grow sustainably while protecting their mental health and resilience. He also contributed to Scaling Up (Rockefeller Habits 2.0). Based in Vancouver, he leads Lawrence & Co, a boutique firm of growth advisors.